Poverty advocates rejoice as interest on payday loans capped in federal budget

It's the news poverty advocates have been waiting for.

The Government of Canada will introduce changes to the Criminal Code by lowering the criminal rate of interest from the equivalent of 47 per cent to 35 per cent annual percentage rate (APR).

"It’s exciting when they finally started to listen,” said Donna Borden, a national ACORN leader and a champion of ACORN’s fair banking campaign.

“We’ve had 300-to-400 people going into a bank protesting and going into these places and protesting over and over and over again and eventually they said, ‘Oh, you know what they [federal government] are right, something should be done.”

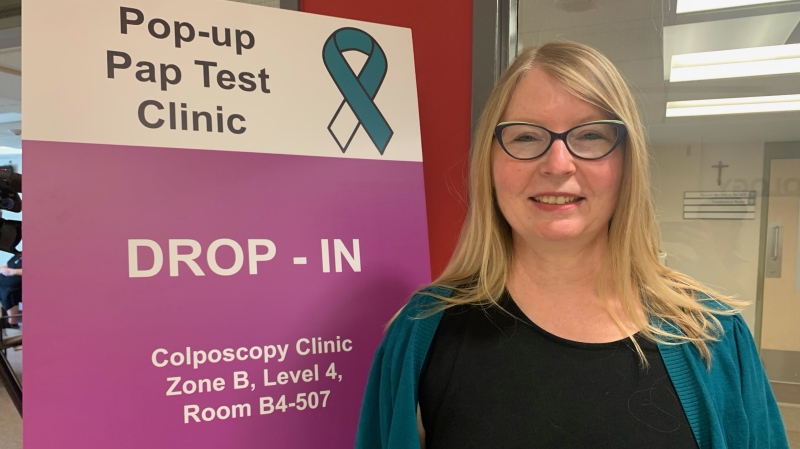

Betty Morrison is a London, Ont. resident who has been struggling to get out of debt for two decades after signing up for an initial high interest cash advance

“I just keep getting roped into those places,” explained Morrison, who said she’s needed money for family medical issues, animal issues and to move out of an unsafe apartment on short notice.

Many Canadians like Morrison are not approved for lower interest bank loans, and have no choice but to sign up for quick cash installment loans with interest up to 60 per cent annually.

“When you are on ODSP you barely can get food or shelter,” she said.

ACORN London staged a protest in London, Ont. on Jan. 24, 2023 in relation to high-interest loans. (Gerry Dewan/CTV News London) The Canadian Consumer Finance Association (CCFA), which represents hundreds of lenders, said they are “deeply disappointed” by the measures set out in the budget. They claim installment and short-term payday loans are an essential service to Canadians who have been refused credit by traditional banks.

ACORN London staged a protest in London, Ont. on Jan. 24, 2023 in relation to high-interest loans. (Gerry Dewan/CTV News London) The Canadian Consumer Finance Association (CCFA), which represents hundreds of lenders, said they are “deeply disappointed” by the measures set out in the budget. They claim installment and short-term payday loans are an essential service to Canadians who have been refused credit by traditional banks.

“While it makes a good headline, the effect of the government’s action will not make credit more affordable,” the CCFA told CTV News London in a statement. “Instead it will have the effect of excluding access to credit to those Canadians on the bottom rungs of the credit ladder.”

The CCFA added payday lending is licenced and regulated in each province. The maximum lending rate is set by each province after careful consultation and review by that provincial government.

“The intrusion by the federal government on provincial jurisdiction to set maximum lending rates for payday loans without any research or consultation is bad public policy,” said the CCFA. “It will drive Canadians to illegal unlicensed online lenders who provide loans at higher rates and with no consumer protections.”

ACORN Canada feels capping the APR will save Canadians millions of dollars.

“It shows that it pays to keep speaking up, and fighting for something,” said Borden of their tireless and relentless advocacy.

ACORN and Morrison both wanted to see rates as low as 30 per cent, but feel this is a big step in the right direction.

I don't want to see them again, but it will help other people,” said Morrison, who hopes to never have to set foot in a lender again. “Anyone who needs support at least they don’t have to pay that interest.”

The government has also committed to launch consultations to see if the APR can be further reduced.

CTVNews.ca Top Stories

Spectacular aurora light show to be seen across Canada Friday night

A rare and severe solar storm is expected to bring spectacular displays of the northern lights, also known as aurora borealis, across much of Canada and parts of the United States on Friday night.

Which Canadian cities have the highest and lowest grocery prices?

Where you live plays a big factor in what you pay at the grocery store. And while it's no secret the same item may have a different price depending on the store, city or province, we wanted to see just how big the differences are, and why.

McGill University seeks emergency injunction to dismantle pro-Palestinian encampment

McGill University has filed a request for an injunction to have the pro-Palestinian encampment removed from its campus.

Swarm of 20,000 bees gather around woman’s car west of Toronto

A swarm of roughly 20,000 bees gathered around a woman’s car in the parking lot of Burlington Centre.

U.S. says Israel's use of U.S. arms likely violated international law, but evidence is incomplete

The Biden administration said Friday that Israel's use of U.S.-provided weapons in Gaza likely violated international humanitarian law but wartime conditions prevented U.S. officials from determining that for certain in specific airstrikes.

Barron Trump declines to serve as an RNC delegate

Former U.S. President Donald Trump's youngest son, Barron Trump, has declined to serve as a delegate at this summer’s Republican National Convention, according to a senior Trump campaign adviser and a statement from Melania Trump's office.

Mother assaulted by stranger while breastfeeding baby in her car: Vancouver police

A person was arrested in East Vancouver Thursday after allegedly entering a car while a mother was breastfeeding her four-month-old boy.

'We have laws': Premier Smith says police action justified in Calgary

The actions, including the decision to use non-lethal force, to disperse pro-Palestinian protesters from the University of Calgary campus were justified, Alberta Premier Danielle Smith said Friday.

'State or state-sponsored actor' believed to be behind B.C. government hacks

The head of British Columbia’s civil service has revealed that a “state or state-sponsored actor” is behind multiple cyber-security incidents against provincial government networks.