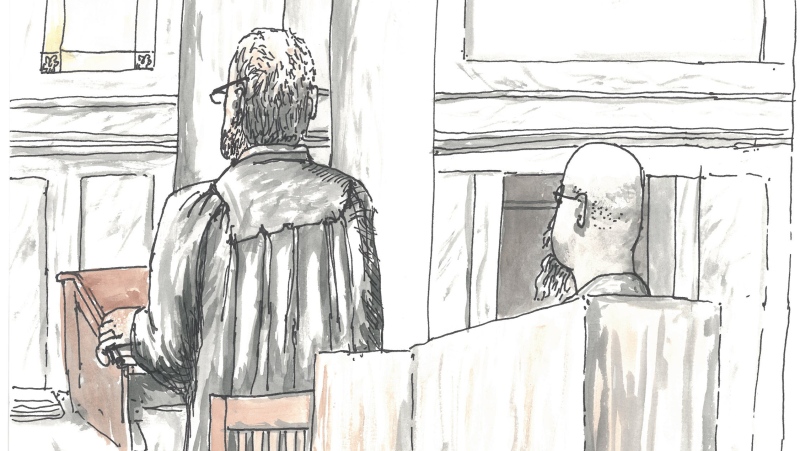

High interest rates take toll on city hall’s $30 million debt issuance this year

An undated image of London city hall. (Daryl Newcombe/CTV News London)

An undated image of London city hall. (Daryl Newcombe/CTV News London)

Everyone is feeling the pain of higher interest rates—even city hall.

On Monday, the Corporate Service Committee (CSC) held a brief meeting to consider the results of a serial debenture issuance for $30 million to fund a number of capital projects.

The net interest rate is 4.427 per cent over the 10-year term.

“While interest rates are higher, the principal amount to be issued is lower than budgeted for 2024,” the CSC report states. “The total debt servicing cost is accommodated within the existing established budget for 2024 due to the lower than budgeted amount of the debt issuance.”

London’s borrowing costs are typically lower than other Canadian municipalities because it has maintained a stellar AAA credit rating since 1977.

“The City’s AAA credit rating allows the City to achieve the most favourable rates possible, given the City’s credit profile and prevailing market conditions,” reads the report.

Over the past five years, the City of London has issued a total of approximately $150.9 million in debentures.

Rising interest rates have seen the city’s cost of borrowing increase from a historic low in 2020.

- 2024: $30,000,000 — 4.427 per cent

- 2023: $21,500,000 — 3.88 per cent

- 2022: $21,000,000 — 3.56 per cent

- 2021: $23,000,000 — 1.82 per cent

- 2020: $36,000,000 — 1.67 per cent

A list of capital projects financed through debt is contained in the appendix of the CSC report.

Council is expected to approve the 2024 debt issuance at its meeting on April 23.

CTVNews.ca Top Stories

Princess Anne to take part in B.C. ceremony bringing new ship into Pacific fleet

Canada's first Arctic and Offshore Patrol Vessel will officially be brought into the Pacific fleet today and Princess Anne, the sister of King Charles, is scheduled to take part in its commissioning ceremony.

NEW Biscuits with possible plastic pieces, metal found in ground pork: Here are the recalls for this week

Here are the latest recalls Canadians should watch out for, according to Health Canada and the Canadian Food Inspection Agency.

More than half of Canadians say freedom of speech is under threat, new poll suggests

A new poll suggests a majority of Canadians feel their right to freedom of speech is in danger.

How falling for a stranger she met on a beach led this woman to ditch the U.S. for the French Riviera

Niki Benjamin, from the U.S., had travelled to a paradise island to do some soul searching, and her life ended up going in a very different direction when her dog ran up to a stranger.

Britney Spears 'home and safe' after paramedics responded to an incident at the Chateau Marmont, source tells CNN

A source close to singer Britney Spears tells CNN that the pop star is 'home and safe' after she had a 'major fight' with her boyfriend on Wednesday night at the Chateau Marmont in West Hollywood.

Feds giving Toronto more than $104M to host 2026 FIFA World Cup

The federal government will provide Toronto just over $104 million in funding to host the 2026 FIFA World Cup.

Police move in to clear NYU encampment, U.S. campus arrests grow to 2,200 in pro-Palestinian protests

Police moved in to clear an encampment at New York University on Friday at the request of school officials, a move that follows weeks of pro-Palestinian protests at college campuses nationwide that have resulted in nearly 2,200 arrests by police.

Wally, the emotional support alligator once denied entry to a baseball game, is missing

Emotional support animal registrations in the United States reached 115,832 last year, by an industry group’s count. But in the eyes of reptile rescuer Joie Henney, there’s only one: 'Wally Gator.'

Parents of infant who died in wrong-way crash on Ontario's Hwy. 401 were in same vehicle

Ontario’s Special Investigations Unit has released new details about a wrong-way collision in Whitby on Monday night that claimed the lives of four people.