London, Ont. housing market in flux

London’s housing market is going through a phase that sees the price of single homes dropping while rents for tenants are increasing sharply.

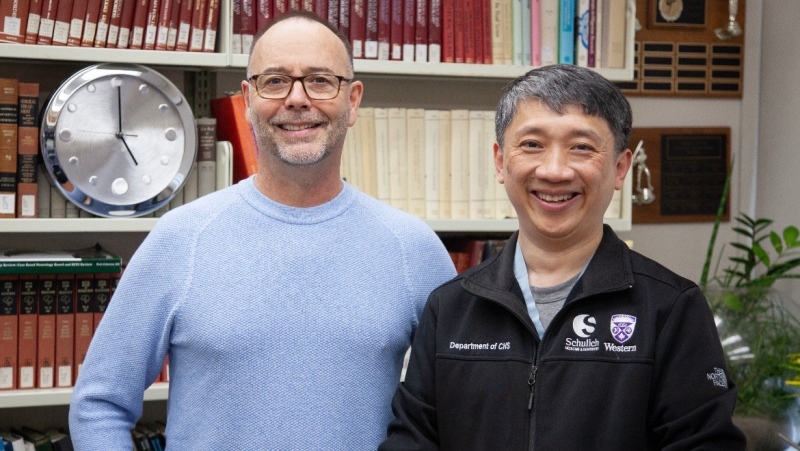

“Right now it’s not really working for buyers or renters,” says Mike Moffatt, a professor at the Ivey School of Business.

In February, the average sale price in London was $825,221 and just last month that dropped to $648,036.

“Yes, prices have gone down a fair bit but interest rates have gone through the roof,” adds Moffatt. “A year ago you could get a mortgage for under two percent and now you’re lucky if you get one under five per cent.”

At the same time, statistics from Rentalsdot.ca show that London’s rent increases are among the highest in the country with a jump of 26.5 per cent.

“That’s partly due to people not buying homes and renting instead but also London’s population is just booming," Moffatt says.

Moffatt adds that the pressure could be eased if the rental inventory was better in London.

“We’re going to have to build more supply because quite frankly there are more people looking to rent properties than there are properties,” he says.

CTVNews.ca Top Stories

Expert warns of food consumption habits amid rising prices

A new survey by Dalhousie University's Agri-Food Analytics Lab asked Canadians about their food consumption habits amid rising prices.

opinion The special relationship between King Charles and the Princess of Wales

Royal commentator Afua Hagan writes that when King Charles recently admitted Catherine to the Order of the Companions of Honour, it not only made history, but it reinforced the strong bond between the King and his beloved daughter-in-law.

Dozens of U.S. deaths reveal risks of injecting sedatives into people restrained by police

The practice of giving sedatives to people detained by police has spread quietly across the U.S. over the last 15 years, built on questionable science and backed by police-aligned experts, an investigation led by The Associated Press has found.

Charlie Woods, son of Tiger, shoots 81 in U.S. Open qualifier

Charlie Woods failed to advance in a U.S. Open local qualifying event Thursday, shooting a 9-over 81 at Legacy Golf & Tennis Club.

Improve balance and build core strength with this exercise

When it comes to cardiovascular fitness, you may tend to focus on activities that move you forward, such as walking, running and cycling.

B.C. tenants evicted for landlord's use after refusing large rent increase to take over neighbouring suite

Ashley Dickey and her mother rented part of the same Coquitlam duplex in three different decades under three different landlords.

Mountain guide dies after falling into a crevasse in Banff National Park

A man who fell into a crevasse while leading a backcountry ski group deep in the Canadian Rockies has died.

MPP Sarah Jama asked to leave Ontario legislature for wearing keffiyeh

MPP Sarah Jama was asked to leave the Legislative Assembly of Ontario by House Speaker Ted Arnott on Thursday for wearing a keffiyeh, a garment which has been banned at Queen’s Park.

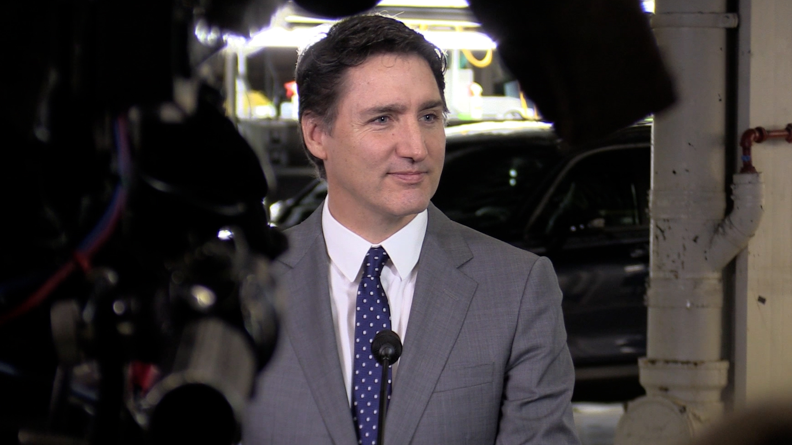

Here's why provinces aren't following Saskatchewan's lead on the carbon tax home heating fight

After Prime Minister Justin Trudeau said the federal government would still send Canada Carbon Rebate cheques to Saskatchewan residents, despite Saskatchewan Premier Scott Moe's decision to stop collecting the carbon tax on natural gas or home heating, questions were raised about whether other provinces would follow suit. CTV News reached out across the country and here's what we found out.