Poverty advocates rejoice as interest on payday loans capped in federal budget

It's the news poverty advocates have been waiting for.

The Government of Canada will introduce changes to the Criminal Code by lowering the criminal rate of interest from the equivalent of 47 per cent to 35 per cent annual percentage rate (APR).

"It’s exciting when they finally started to listen,” said Donna Borden, a national ACORN leader and a champion of ACORN’s fair banking campaign.

“We’ve had 300-to-400 people going into a bank protesting and going into these places and protesting over and over and over again and eventually they said, ‘Oh, you know what they [federal government] are right, something should be done.”

Betty Morrison is a London, Ont. resident who has been struggling to get out of debt for two decades after signing up for an initial high interest cash advance

“I just keep getting roped into those places,” explained Morrison, who said she’s needed money for family medical issues, animal issues and to move out of an unsafe apartment on short notice.

Many Canadians like Morrison are not approved for lower interest bank loans, and have no choice but to sign up for quick cash installment loans with interest up to 60 per cent annually.

“When you are on ODSP you barely can get food or shelter,” she said.

ACORN London staged a protest in London, Ont. on Jan. 24, 2023 in relation to high-interest loans. (Gerry Dewan/CTV News London) The Canadian Consumer Finance Association (CCFA), which represents hundreds of lenders, said they are “deeply disappointed” by the measures set out in the budget. They claim installment and short-term payday loans are an essential service to Canadians who have been refused credit by traditional banks.

ACORN London staged a protest in London, Ont. on Jan. 24, 2023 in relation to high-interest loans. (Gerry Dewan/CTV News London) The Canadian Consumer Finance Association (CCFA), which represents hundreds of lenders, said they are “deeply disappointed” by the measures set out in the budget. They claim installment and short-term payday loans are an essential service to Canadians who have been refused credit by traditional banks.

“While it makes a good headline, the effect of the government’s action will not make credit more affordable,” the CCFA told CTV News London in a statement. “Instead it will have the effect of excluding access to credit to those Canadians on the bottom rungs of the credit ladder.”

The CCFA added payday lending is licenced and regulated in each province. The maximum lending rate is set by each province after careful consultation and review by that provincial government.

“The intrusion by the federal government on provincial jurisdiction to set maximum lending rates for payday loans without any research or consultation is bad public policy,” said the CCFA. “It will drive Canadians to illegal unlicensed online lenders who provide loans at higher rates and with no consumer protections.”

ACORN Canada feels capping the APR will save Canadians millions of dollars.

“It shows that it pays to keep speaking up, and fighting for something,” said Borden of their tireless and relentless advocacy.

ACORN and Morrison both wanted to see rates as low as 30 per cent, but feel this is a big step in the right direction.

I don't want to see them again, but it will help other people,” said Morrison, who hopes to never have to set foot in a lender again. “Anyone who needs support at least they don’t have to pay that interest.”

The government has also committed to launch consultations to see if the APR can be further reduced.

CTVNews.ca Top Stories

B.C. tenants evicted for landlord's use after refusing large rent increase to take over neighbouring suite

Ashley Dickey and her mother rented part of the same Coquitlam duplex in three different decades under three different landlords.

Mountain guide dies after falling into a crevasse in Banff National Park

A man who fell into a crevasse while leading a backcountry ski group deep in the Canadian Rockies has died.

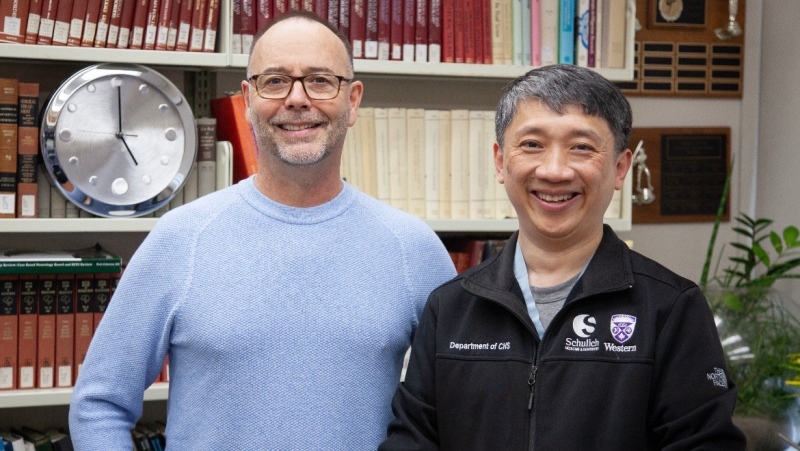

Expert warns of food consumption habits amid rising prices

A new survey by Dalhousie University's Agri-Food Analytics Lab asked Canadians about their food consumption habits amid rising prices.

MPP Sarah Jama asked to leave Ontario legislature for wearing keffiyeh

MPP Sarah Jama was asked to leave the Legislative Assembly of Ontario by House Speaker Ted Arnott on Thursday for wearing a keffiyeh, a garment which has been banned at Queen’s Park.

Charlie Woods, son of Tiger, shoots 81 in U.S. Open qualifier

Charlie Woods failed to advance in a U.S. Open local qualifying event Thursday, shooting a 9-over 81 at Legacy Golf & Tennis Club.

Ex-tabloid publisher testifies he scooped up possibly damaging tales to shield his old friend Trump

As Donald Trump was running for president in 2016, his old friend at the National Enquirer was scooping up potentially damaging stories about the candidate and paying out tens of thousands of dollars to keep them from the public eye.

Here's why provinces aren't following Saskatchewan's lead on the carbon tax home heating fight

After Prime Minister Justin Trudeau said the federal government would still send Canada Carbon Rebate cheques to Saskatchewan residents, despite Saskatchewan Premier Scott Moe's decision to stop collecting the carbon tax on natural gas or home heating, questions were raised about whether other provinces would follow suit. CTV News reached out across the country and here's what we found out.

Montreal actress calls Weinstein ruling 'discouraging' but not surprising

A Montreal actress, who has previously detailed incidents she had with disgraced Hollywood producer Harvey Weinstein, says a New York Court of Appeals decision overturning his 2020 rape conviction is 'discouraging' but not surprising.

Caleb Williams, Jayden Daniels and Drake Maye make it four NFL drafts with quarterbacks going 1-3

Caleb Williams is heading to the Windy City, aiming to become the franchise quarterback Chicago has sought for decades.