TORONTO -- Businesses and investors are rushing to partner with the 25 winners of the Ontario cannabis retail licence lottery, with offers apparently worth millions of dollars, to be involved in the province's first recreational weed stores set to open this spring.

Olivia Brown, the founder of Hamilton, Ont.-based Professional Cannabis Consulting, says one of her clients was among the 25 entities selected by the province via lottery, and has fielded three "big offers" on Monday alone.

"There's a couple of large investors, one from the United States, one of them from Amsterdam... a very established Hamilton family looking to invest," said Brown, who said her client did not want to be named.

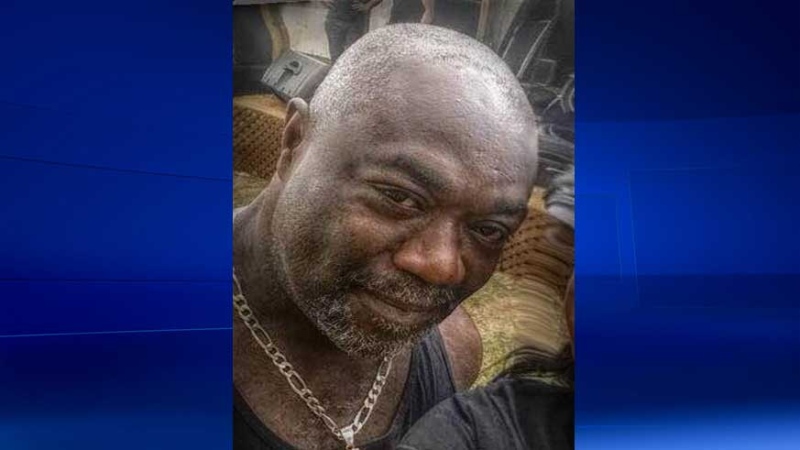

The Alcohol and Gaming Commission of Ontario announced late Friday the 25 entities who can now apply for a cannabis retail licence in Canada's most populous province, out of the 17,320 expressions of interest the government agency received. There were also 100 applicants on the wait list.

The biggest industry players, however, were kept at bay as the province's regulations stipulate applicants cannot qualify for a retail licence if it is more than 9.9 per cent owned or controlled by one or more licensed producer.

The vast majority of those lottery entries were from sole proprietorships, at 64 per cent, followed by corporations at 33 per cent, and partnerships and limited partnerships at three and one per cent, respectively.

There were no big cannabis industry names among the 25 winners, who now have five business days to turn in their applications to the AGCO along with a $6,000 non-refundable fee and a $50,000 letter of credit.

They included Toronto-based travel agency Tripsetter Inc., who declined to comment when reached by phone.

If their applications are successful, they will have the opportunity to open the first 25 recreational pot stores on April 1 in Ontario, where cannabis consumers now can only legally purchase weed from a government-run website.

However, these retail operator licences are not transferable under provincial regulations, which has companies and investors scrambling to find ways to partner with the lottery winners as allowed under the rules and cash in on the first-mover advantage.

"Everybody is trying to find one of the winners and trying to cut some sort of a deal with them," said Mark Goliger, chief executive officer of National Access Cannabis Corp.

NAC, which has signed an agreement with coffee chain Second Cup to convert some of its coffee shops into weed dispensaries, has been in touch with a handful of lottery winners and is seeking a partnership, such as a services agreement or revenue-sharing arrangement.

"We're not going to do a crazy deal that doesn't make sense long-term... I know that there are players out there that are doing crazy deals."

Brendan Kennedy, chief executive of licensed producer Tilray Inc., said their Nanaimo-based company has been in touch with provincial lottery winners as well.

"Stay tuned... They're looking for potential partners as they build out their entities," he said.

Abi Roach, the owner of Toronto-based Hot Box Cafe, says her lottery entry did not win, but she has been in touch with winners on potential partnerships, and has been told other offers are north of $5 million.

It's a big risk she says she is not willing to take, given that most of the winners are sole proprietors and there are restrictions on changing the structure of the company after entering the lottery, she added.

"The risk of putting in a large sum of money into a sole proprietorship without ownership is crazy," she said.

Although the types of deals that can be made are limited, there was a "flurry of negotiations" over the weekend, said Ottawa-based lawyer Trina Fraser, who is representing clients looking to enter partnerships.

The deals Fraser's clients are seeking include licensing or services agreements, which allow the license holder to retain sufficient control as required under provincial regulations.

Many of the 25 entities selected do not have industry experience, and will likely face difficulties satisfying requirements such as a letter of credit from the bank, she said.

Retail licence operators who are not ready to open their doors by April 1 will face hefty late fines that could total as much as $50,000.

"They need money and they need help," said Fraser. "They don't necessarily have the expertise or the resources to be able to execute on this on their own. They're going to need partners."