A charity with close ties to London Mayor Joe Fontana has lost a federal court appeal, paving the way for the Canada Revenue Agency to strip Trinity Global Support Foundation of its registered charity status.

The judge’s ruling states "the application has been dismissed with costs,” ending the foundation’s efforts to further delay the revocation of its registered charity status.

Trinity Global released a statement shortly after the decision was announced that reads:

“Trinity Global Support Foundation is disappointed with the Federal Court of Appeal's decision to dismiss its application to stay the Minister's decision to revoke its charitable status.

“The Foundation had hoped to continue to carry on its charitable programs, including feeding hungry kids, helping food banks and distributing educational courseware.

“However, the loss of its charitable status will make it difficult for the Foundation to keep helping individuals in need. The Foundation is considering appealing the decision and will be exploring its options. ”

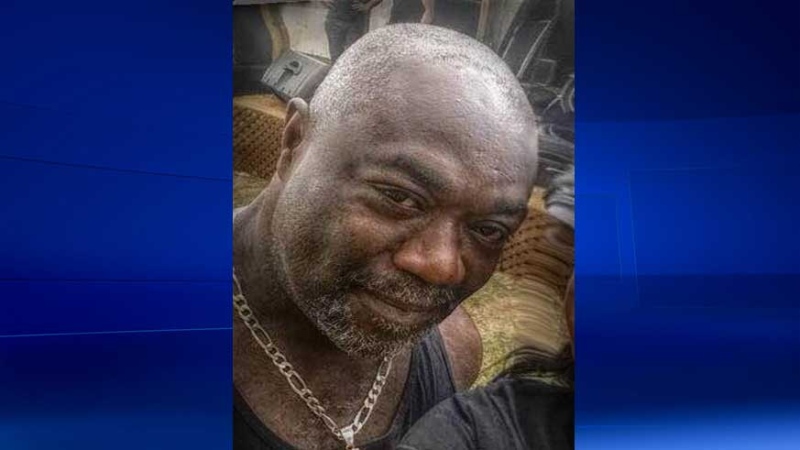

Fontana told CTV News after the decision he is disappointed with the ruling and maintains that foundation is not a tax shelter.

“We won't be able to offer any receipts, but obviously we are going to try and continue to help as much as we possibly can.”

According to documents filed with the Canada Revenue Agency (CRA), the foundation issued more than $152 million in tax receipts in 2012, primarily for the value of non-cash gifts.

Fontana currently sits on the foundation’s board and is a past board chair. His son Joe Fontana Jr. is listed on the foundation's website as its president.

The mayor adds that there are still options for the foundation and they may consider an appeal of the decision.

Taxpayers could be on the hook

Prominent tax lawyer David Thompson expects the Canada Revenue Agency will next focus on taxpayers who made donations to the foundation and claimed it on their tax return, to ensure no rules were broken.

“The CRA has publicly stated that if you donate to one of these charity deals, you will be reassessed, you will be audited…they have disallowed more than $5 billion in charitable donations and they have reassessed the individuals who made them for the taxes, for interest, and in many cases, for penalties.”

That’s because signing a return makes the taxpayer responsible for all of the information contained inside.

According to Thompson, penalties for inconsistencies can reach into the thousands of dollars.

If you made a donation he recommends contacting an accountant or tax lawyer and the CRA, so they can sort out whether the value of the charitable receipt will be accepted.