Poverty advocates rejoice as interest on payday loans capped in federal budget

It's the news poverty advocates have been waiting for.

The Government of Canada will introduce changes to the Criminal Code by lowering the criminal rate of interest from the equivalent of 47 per cent to 35 per cent annual percentage rate (APR).

"It’s exciting when they finally started to listen,” said Donna Borden, a national ACORN leader and a champion of ACORN’s fair banking campaign.

“We’ve had 300-to-400 people going into a bank protesting and going into these places and protesting over and over and over again and eventually they said, ‘Oh, you know what they [federal government] are right, something should be done.”

Betty Morrison is a London, Ont. resident who has been struggling to get out of debt for two decades after signing up for an initial high interest cash advance

“I just keep getting roped into those places,” explained Morrison, who said she’s needed money for family medical issues, animal issues and to move out of an unsafe apartment on short notice.

Many Canadians like Morrison are not approved for lower interest bank loans, and have no choice but to sign up for quick cash installment loans with interest up to 60 per cent annually.

“When you are on ODSP you barely can get food or shelter,” she said.

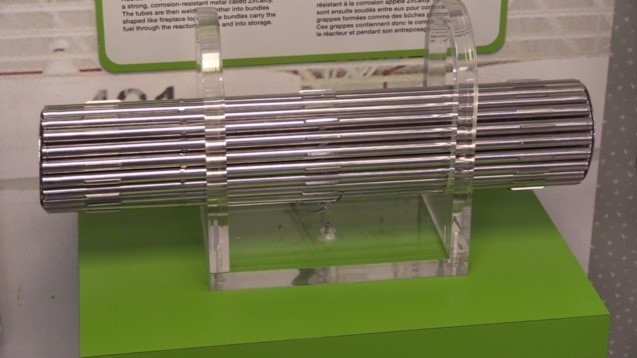

ACORN London staged a protest in London, Ont. on Jan. 24, 2023 in relation to high-interest loans. (Gerry Dewan/CTV News London) The Canadian Consumer Finance Association (CCFA), which represents hundreds of lenders, said they are “deeply disappointed” by the measures set out in the budget. They claim installment and short-term payday loans are an essential service to Canadians who have been refused credit by traditional banks.

ACORN London staged a protest in London, Ont. on Jan. 24, 2023 in relation to high-interest loans. (Gerry Dewan/CTV News London) The Canadian Consumer Finance Association (CCFA), which represents hundreds of lenders, said they are “deeply disappointed” by the measures set out in the budget. They claim installment and short-term payday loans are an essential service to Canadians who have been refused credit by traditional banks.

“While it makes a good headline, the effect of the government’s action will not make credit more affordable,” the CCFA told CTV News London in a statement. “Instead it will have the effect of excluding access to credit to those Canadians on the bottom rungs of the credit ladder.”

The CCFA added payday lending is licenced and regulated in each province. The maximum lending rate is set by each province after careful consultation and review by that provincial government.

“The intrusion by the federal government on provincial jurisdiction to set maximum lending rates for payday loans without any research or consultation is bad public policy,” said the CCFA. “It will drive Canadians to illegal unlicensed online lenders who provide loans at higher rates and with no consumer protections.”

ACORN Canada feels capping the APR will save Canadians millions of dollars.

“It shows that it pays to keep speaking up, and fighting for something,” said Borden of their tireless and relentless advocacy.

ACORN and Morrison both wanted to see rates as low as 30 per cent, but feel this is a big step in the right direction.

I don't want to see them again, but it will help other people,” said Morrison, who hopes to never have to set foot in a lender again. “Anyone who needs support at least they don’t have to pay that interest.”

The government has also committed to launch consultations to see if the APR can be further reduced.

CTVNews.ca Top Stories

LIVE NOW Budget 2024 prioritizes housing while taxing highest earners, deficit projected at $39.8B

In an effort to level the playing field for young people, in the 2024 federal budget, the government is targeting Canada's highest earners with new taxes in order to help offset billions in new spending to enhance the country's housing supply and social supports.

BUDGET 2024 Feds cutting 5,000 public service jobs, looking to turn underused buildings into housing

Five thousand public service jobs will be cut over the next four years, while underused federal office buildings, Canada Post properties and the National Defence Medical Centre in Ottawa could be turned into new housing units, as the federal government looks to find billions of dollars in savings and boost the country's housing portfolio.

Some of the winners and losers in the 2024 federal budget

With a variety of fiscal and policy measures announced in the federal budget, winners include small businesses and fintech companies while losers include the tobacco industry and Canadian pension funds.

From housing initiatives to a disability benefit, how the federal budget impacts you

From plans to boost new housing stock, encourage small businesses, and increase taxes on Canada’s top-earners, CTVNews.ca has sifted through the 416-page budget to find out what will make the biggest difference to your pocketbook.

Liberals aim to hit the brakes on car theft with new criminal offences

The Liberals are proposing new charges for the use of violence while stealing a vehicle and for links to organized crime, as well as laundering money for the benefit of a criminal organization.

BUDGET 2024 Ottawa police get $50 million to boost security around Parliamentary Precinct

The Ottawa Police Service will receive $50 million in new federal funding over the next five years to "enhance security" around the Parliamentary Precinct.

Liberals to dole out five years worth of carbon rebates to businesses

Small- and medium-sized business owners are set to receive a long-awaited refund from Ottawa, which was holding onto billions of dollars while it sorted out a way to deliver them their carbon pricing rebates.

Feds offer $5B in Indigenous loan guarantees, fall $420B short on infrastructure asks

The federal government is providing up to $5 billion in loan guarantees to help Indigenous communities invest in natural resource and energy products. But when it comes to a promise to close what advocates say is a sprawling Indigenous infrastructure gap, Ottawa is short more than $420 billion.

BREAKING Police to announce arrests in Toronto Pearson airport gold heist

Police say that arrests have been made in connection with a $20-million gold heist at Toronto Pearson International Airport one year ago.